It is necessary to indicate that there is a real-time index of the probabilities of the trade agreement between the United States and China. And it is well known that about a year ago, Jerome Powell was considered the most hawkish Fed chairman in years, perhaps decades, as a result of his determination to raise rates regardless of how the macro environment looked, eventually launching the big sales wave of Q4 with its comment that the federal funds rate is “far from being neutral at this time”, although today the Fed indicated that the neutral rate has been “reduced” to 2.5% or right next.

It is considered that this may be due to that experience that resulted in the first bear market, Powell has retired as a cheap Garden Chair and since January has “surprised” successfully.

In this way it has been said that now that Trump has scared the Federal Reserve to submit to any of the bond markets, which has a price of almost 4 cuts for next year, the only “other” question that matters, and which will determine the outcome of the final S & P. This year’s impression is whether EE. UU and China successfully resolve their trade disputes with a grand deal or at least a ceasefire at the G-20 meeting in Osaka neek.

Good and bad

There is no doubt that there are some good news as well as some bad news.

Speaking mainly of the bad news, it can be highlighted that unlike the Powell dovish, the result here seems much less promising for the bulls. And is that despite the last minute agreement to meet in the G-20, the likelihood of a surprise of the “best case” of the meeting of Trump-Xi is virtually non-existent.

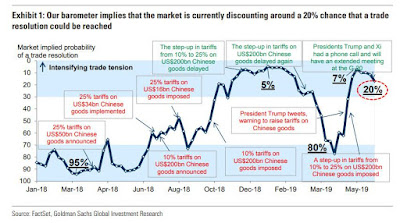

Now, referring to the good news, we can say that thanks to Goldman, there is now a way to track the likelihood of a real-time agreement. And as Goldman’s Chinese research team writes, “understanding how trade risks are discounted in equity valuation is crucial for investors to navigate short-term market volatility and assess tactical risk/reward” and as a result, Goldman has developed a ”trade tension barometer”

In this way, what the trade agreement indicator shows, is that the perceived trade concerns are now moderately below the stress points at the end of 2018 / early 2019, but more importantly, the market seems to have a probability about 20% of a commercial resolution can be hit by both sides, markedly lower since ~ 80% in mid-April.

Source: Tyler Durden | ZeroHedge

No comments:

Post a Comment